Hire us

Hire us to get the best work of your life. Our award winning team will take care of your product as we care about our reputation.

Get startedAl Ansari Exchange (AAE) is a leading UAE-based financial services provider specializing in money exchange, remittance, and payment solutions, operating over 260 branches worldwide. With millions of transactions processed annually, combines its extensive network, advanced technology, and strong regulatory compliance to deliver secure and efficient services. It has positioned itself as an enabler for fintech partners by providing robust support for foreign currency exchange. To strengthen this position, AAE partnered with us to enhance its app infrastructure and technological capabilities, enabling seamless integration with other financial entities for cross-border transactions.

To standout in the competitive financial market, the development team crafted a distinctive platform through intuitive communication and visual language that resonates across diverse user segments. The landing page delivers a clear value proposition while maintaining cultural sensitivity. The solution incorporated enterprise-grade security with end-to-end cryptography and Multi-Factor Authentication/TOTP mechanisms, complemented by robust error prevention systems throughout critical journeys. The payment flow provides real-time system status updates, ensuring transparency and trust. To combat market saturation, the platform introduced strategic customer retention initiatives. The payment infrastructure accommodated diverse needs through receiving options like Direct Bank Transfer, Cash Pickup Service, and Western Union, while sending methods included Dubai Pay Plus cards, Dubai payroll cards, Al Ansari Exchange direct debits, and Visa/Master card transactions.

The platform employs inclusive design principles informed by user research and cohort analysis to ensure an intuitive experience for diverse user groups. The user journey hierarchy is carefully structured, guiding users seamlessly through key interactions. Minimalist single-stroke icons maintain clarity at small sizes and load efficiently, while abstract patterns add sophistication without clutter. A monochromatic design enhances visual harmony, and buttons follow a consistent structure—solid fill for primary actions and outlined for secondary ones—ensuring clear action prioritization across the interface.

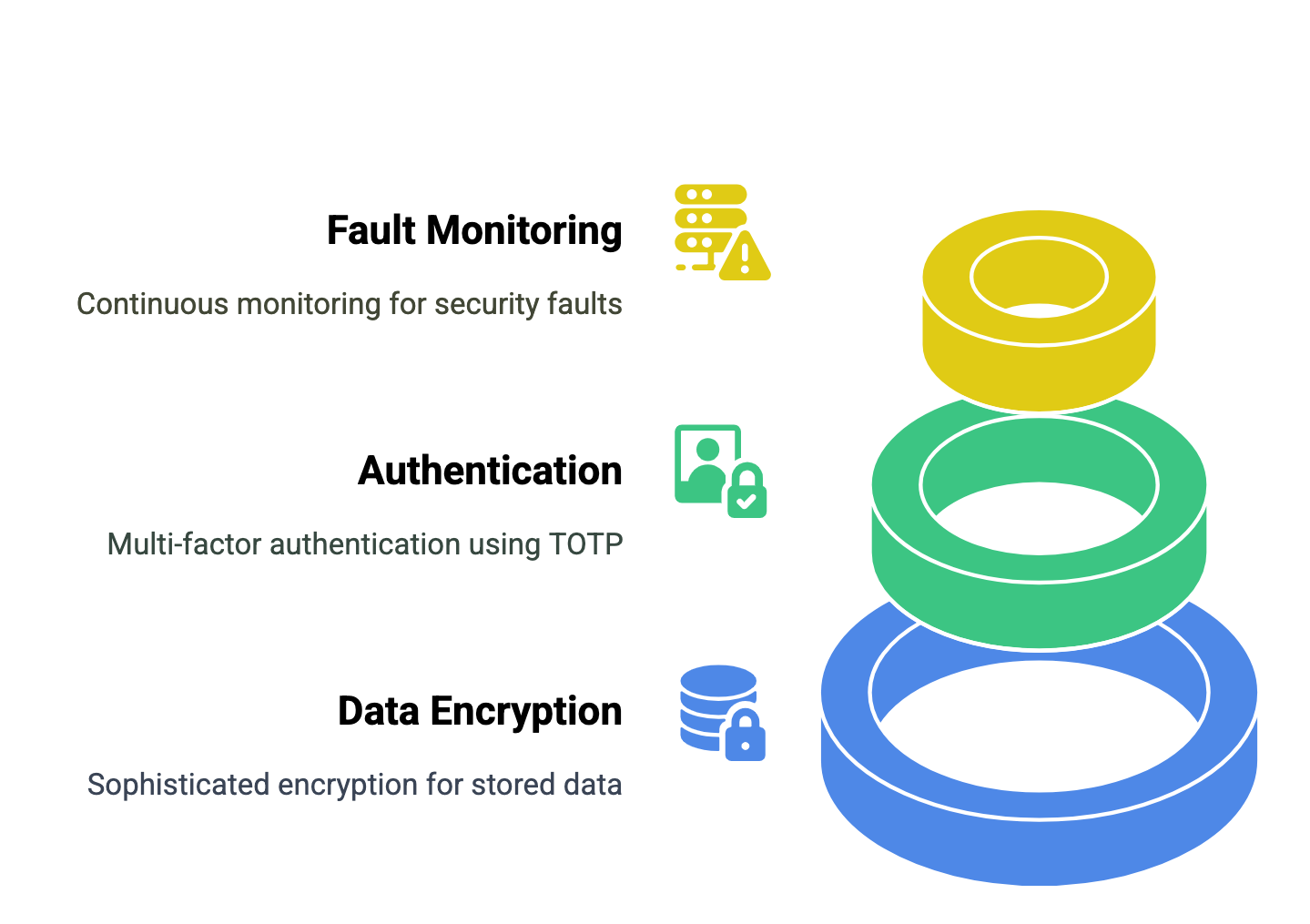

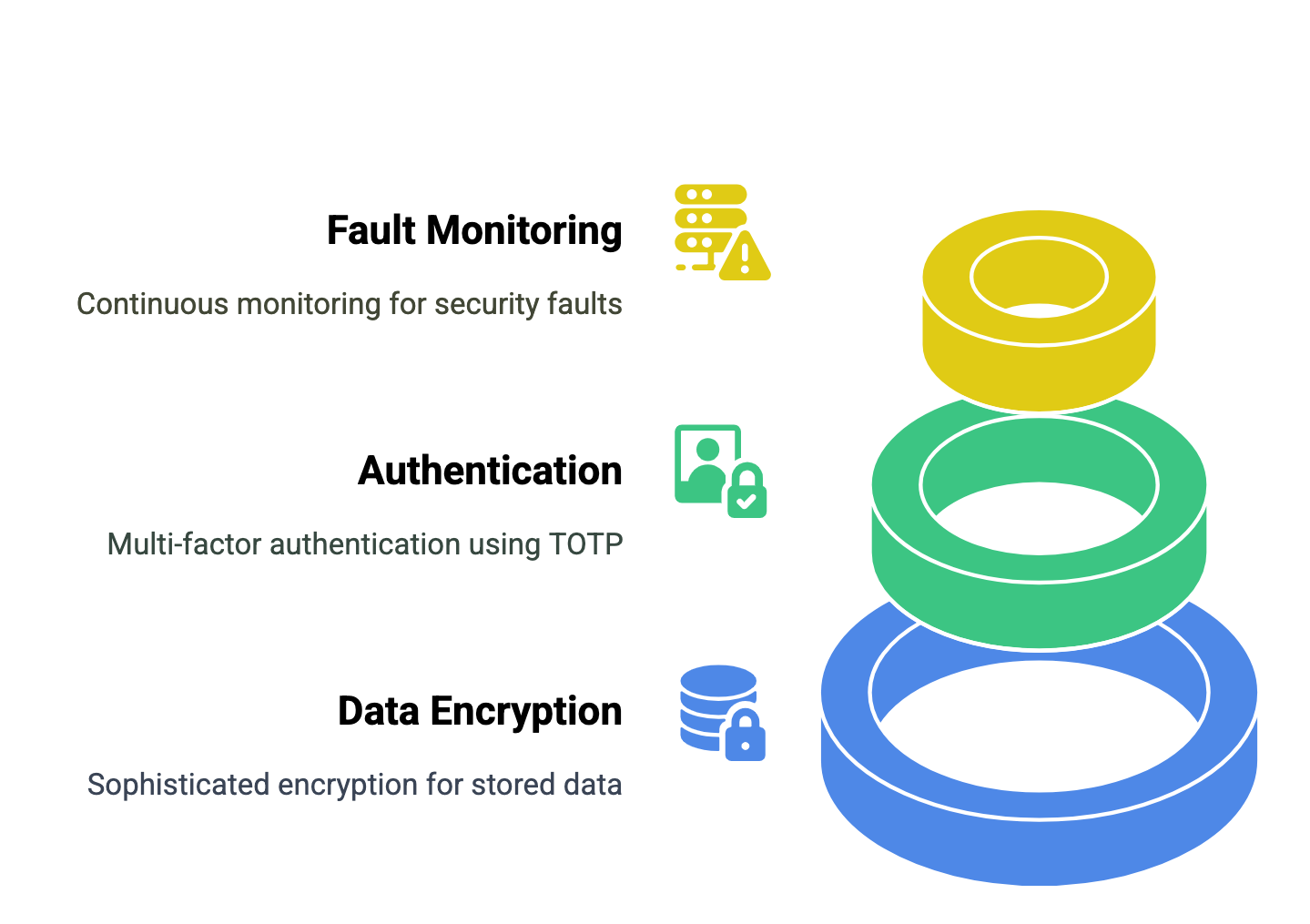

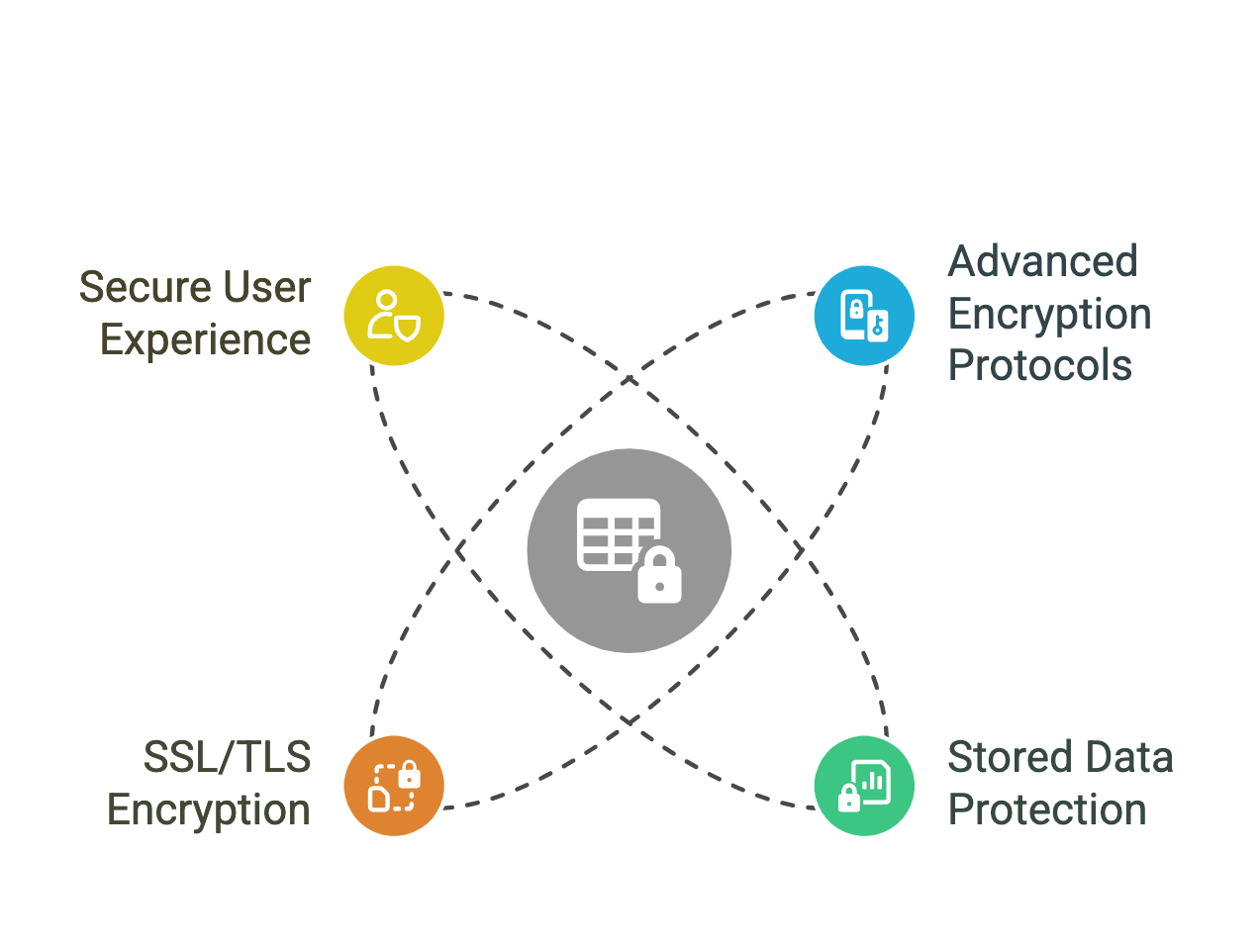

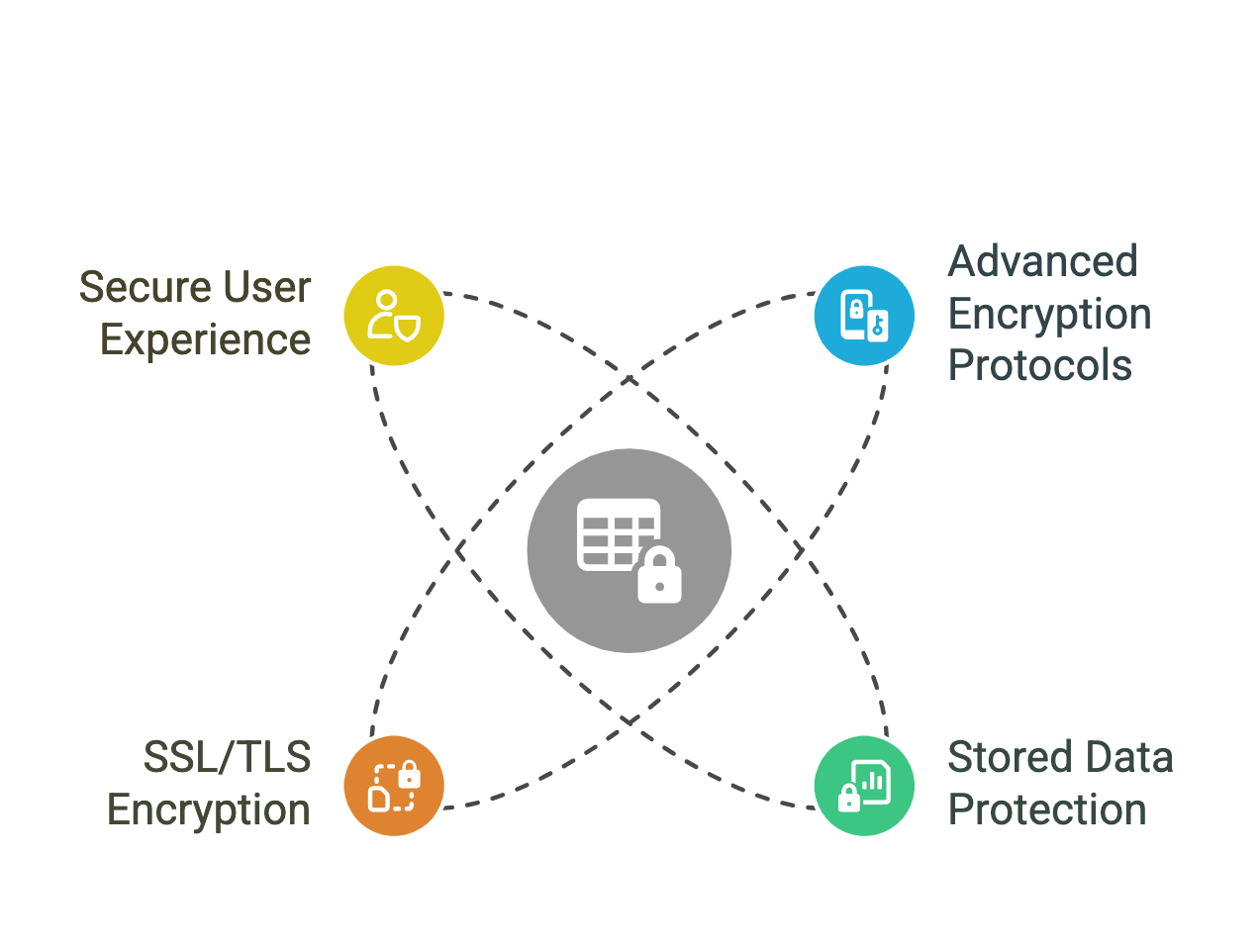

The app implements multi-layered security through sophisticated encryption for stored data, with one-way encryption for critical elements. The three-tier security approach combines multi-factor authentication using TOTP, end-to-end data encryption, and continuous fault monitoring. This comprehensive framework ensures both personal and financial information always remain protected.

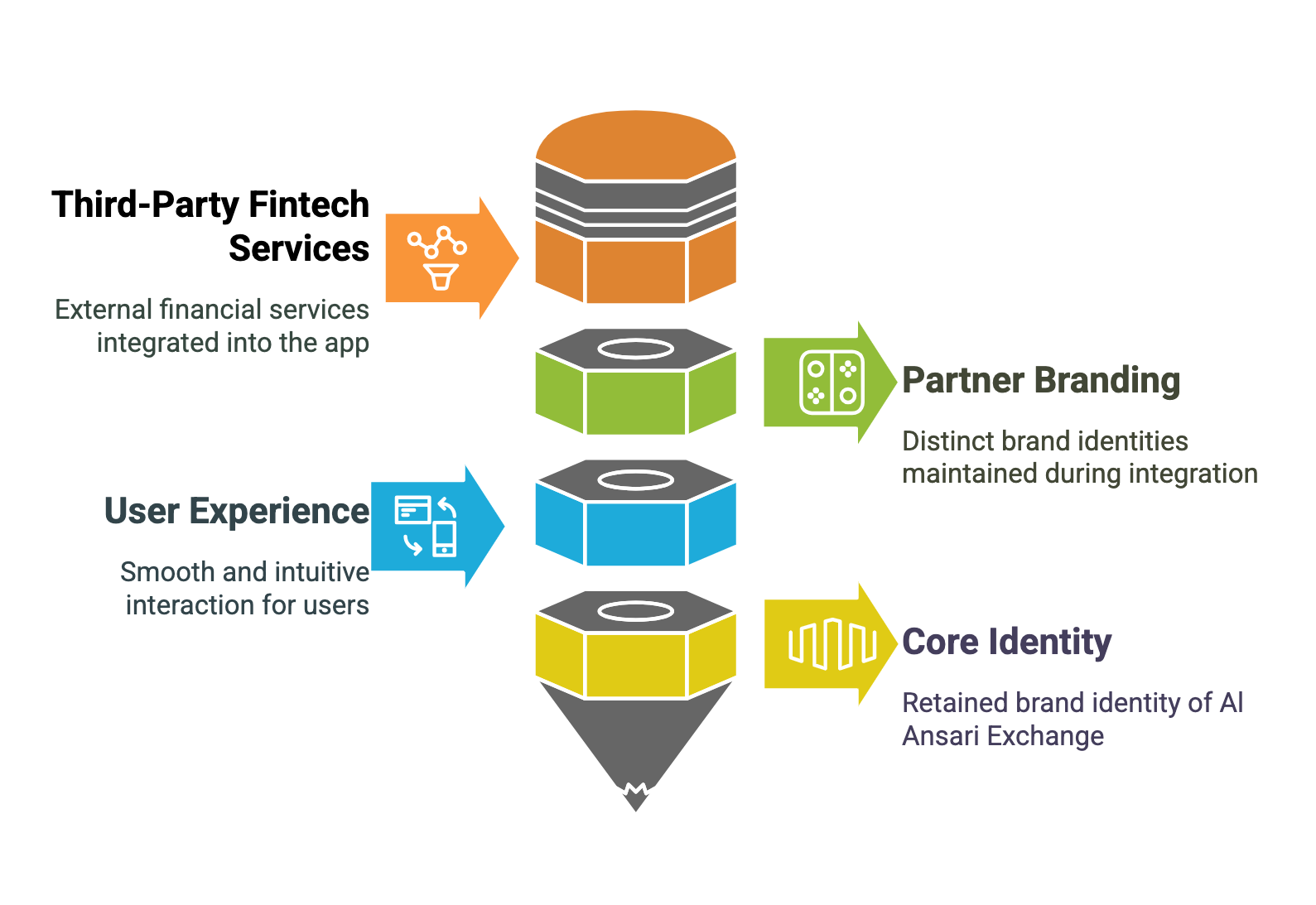

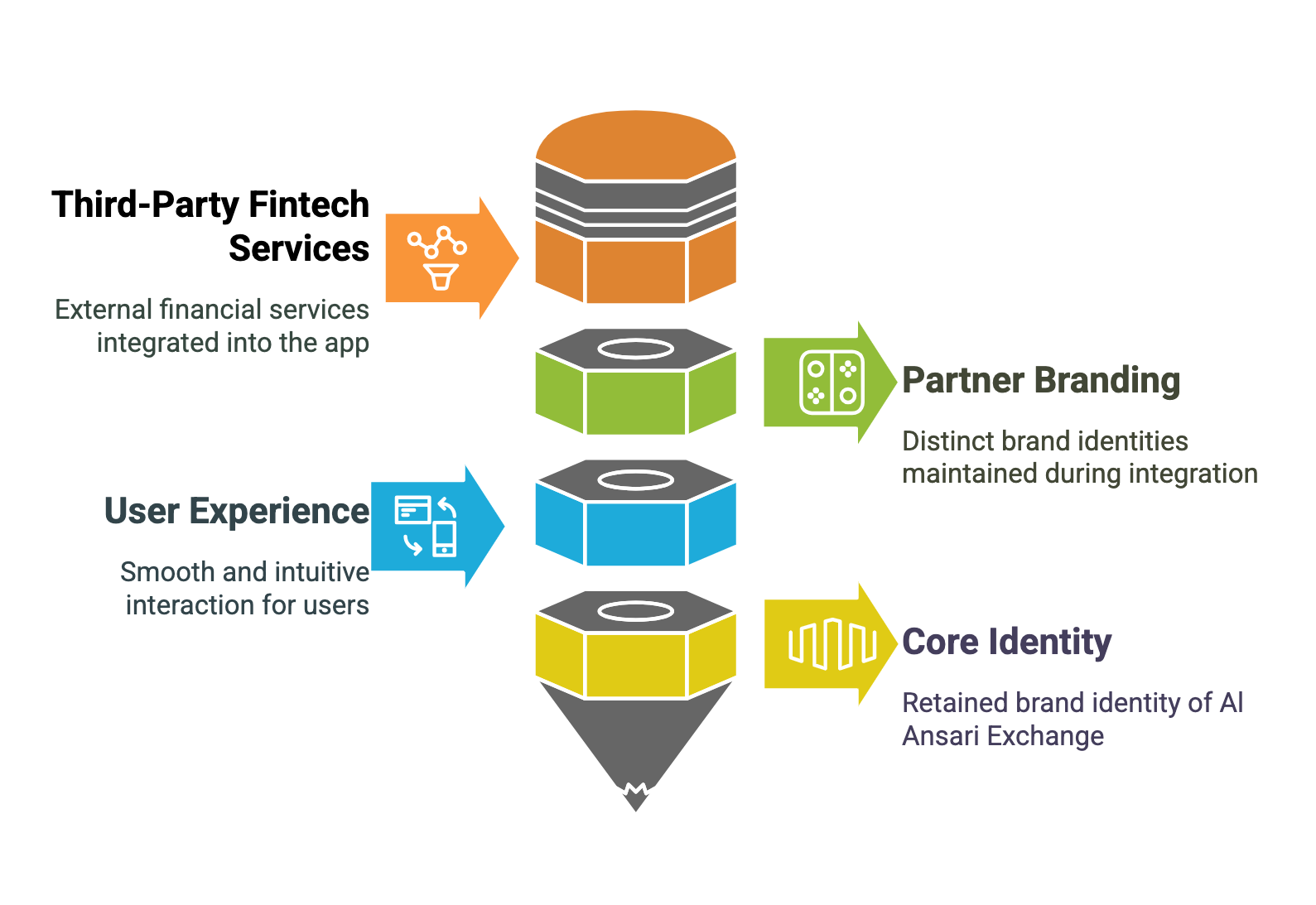

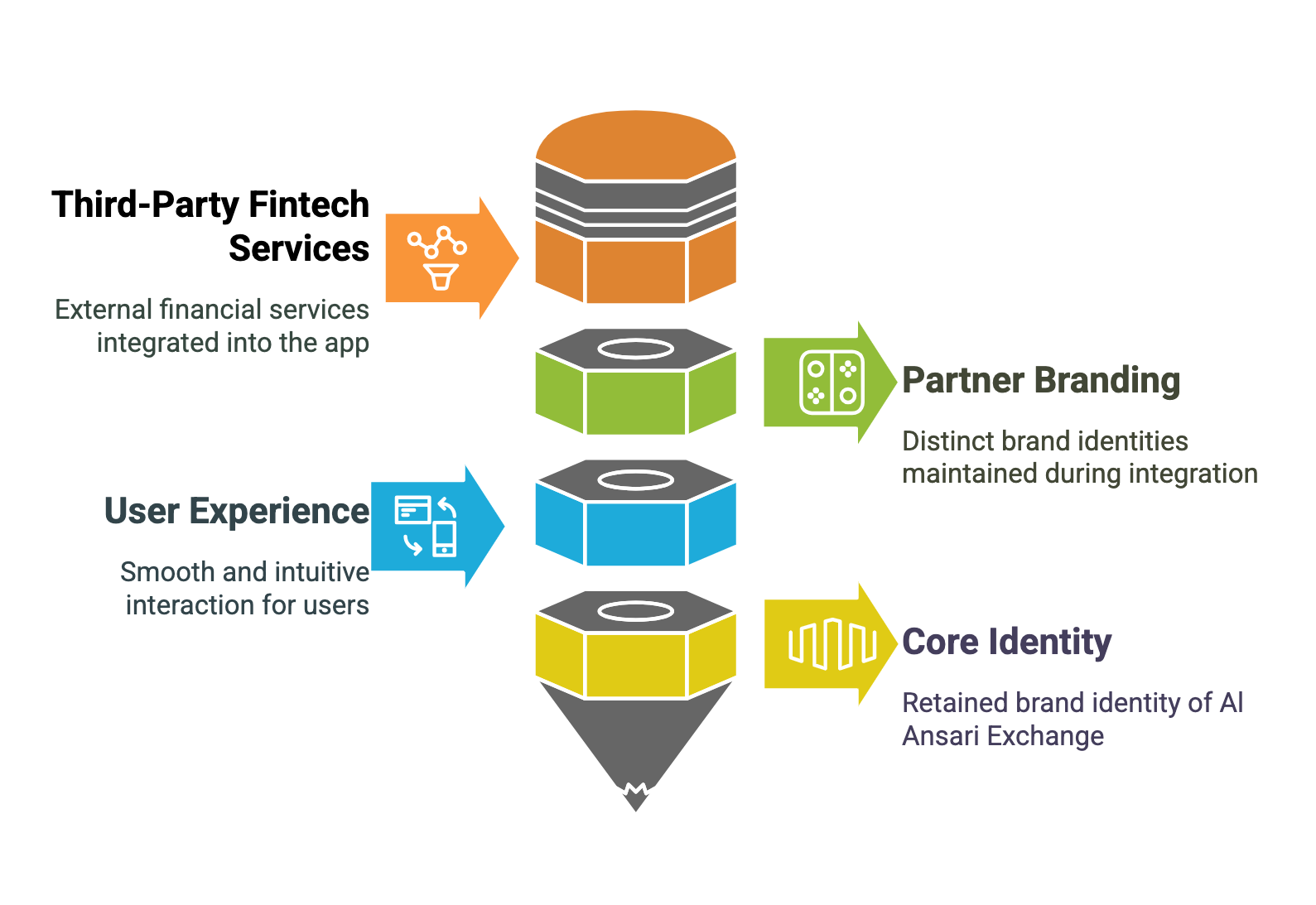

The Al Ansari Exchange app seamlessly integrates third-party fintech services while maintaining each partner’s distinct brand identity. The interface dynamically adapts to incorporate partner branding, ensuring a cohesive yet recognizable experience. Users can interact with their trusted financial services within a unified platform, enjoying a smooth and intuitive journey while Al Ansari Exchange retains its core identity.

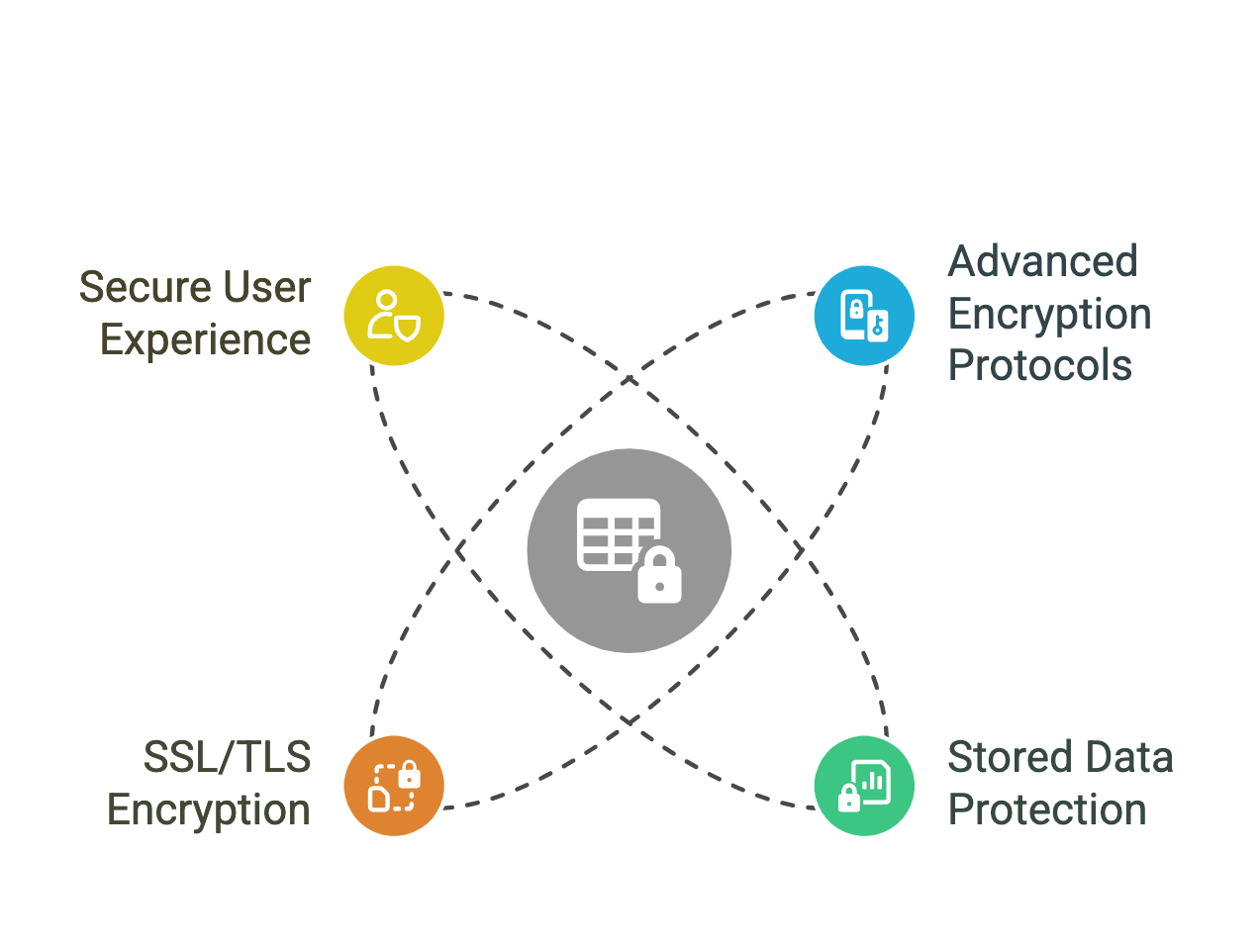

The app safeguards user information using advanced encryption protocols. Stored data including profiles and transaction histories are secured with encryption algorithms to prevent unauthorized access. For data in transit during authentication or transactions, SSL/TLS encryption protects information across networks. These security measures ensure sensitive data remains protected both at rest and in motion, providing a secure, reliable experience.

The app implements multi-layered security through sophisticated encryption for stored data, with one-way encryption for critical elements. The three-tier security approach combines multi-factor authentication using TOTP, end-to-end data encryption, and continuous fault monitoring. This comprehensive framework ensures both personal and financial information always remain protected.

The Al Ansari Exchange app seamlessly integrates third-party fintech services while maintaining each partner’s distinct brand identity. The interface dynamically adapts to incorporate partner branding, ensuring a cohesive yet recognizable experience. Users can interact with their trusted financial services within a unified platform, enjoying a smooth and intuitive journey while Al Ansari Exchange retains its core identity.

The app safeguards user information using advanced encryption protocols. Stored data including profiles and transaction histories are secured with encryption algorithms to prevent unauthorized access. For data in transit during authentication or transactions, SSL/TLS encryption protects information across networks. These security measures ensure sensitive data remains protected both at rest and in motion, providing a secure, reliable experience.

Hire us to get the best work of your life. Our award winning team will take care of your product as we care about our reputation.

Get started